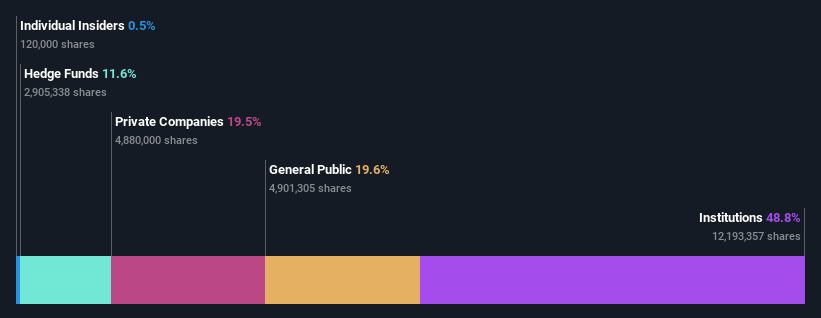

To understand who really controls Global Technology Acquisition Corp. I (NASDAQ:GTAC), it’s important to understand the business’s ownership structure. And the group with the largest piece of the pie is the institution with 49% ownership. In other words, the group stands to gain (or lose) the most from its investment in the company.

Because institutional investors have huge pools of resources and liquidity, their investment decisions tend to be heavily influenced, especially for individual investors. As a result, the significant amount of institutional money invested in companies is generally viewed as a positive attribute.

Let’s take a closer look at each type of Global Technology Acquisition I owner from the table below.

What Does Institutional Ownership Tell Us About Global Technology Acquisitions I?

Institutional investors typically compare their returns to those of commonly followed indices. As such, they typically look to acquire large companies included in the relevant benchmark index.

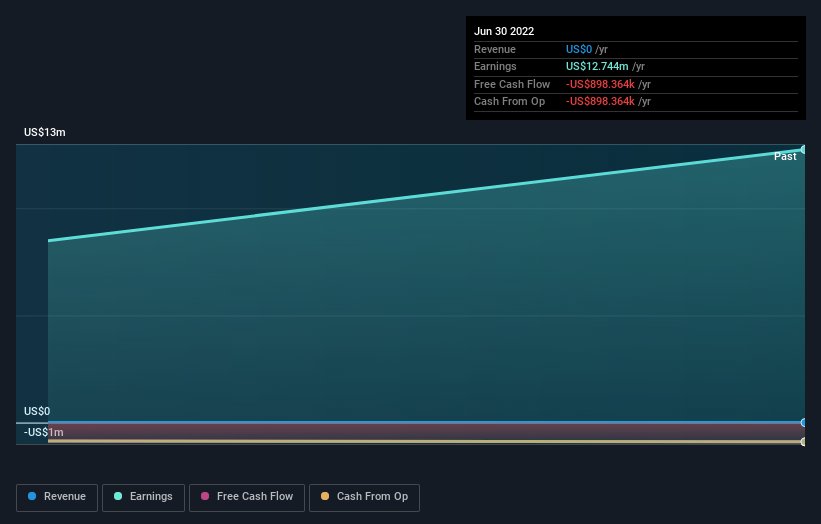

As you can see, Global Technology Acquisition I has a significant share of institutional investors. This may indicate that the company has some credibility in the investment community. However, caution should be exercised in relying on the validation that institutional investors assume. They get it wrong sometimes too. When shares are owned by multiple institutions, there is always the risk of getting into a “congested deal”. If such a deal goes wrong, multiple parties may compete to sell the stock fast. This risk is higher for companies with no history of growth. Here are some of Global Technology Acquisition I’s past earnings and earnings, but remember there’s always more to the story.

12% of Global Technology Acquisition I shares appear to be managed by hedge funds. This catches my attention because hedge funds sometimes try to influence management or make changes that create short-term value for shareholders. The company’s largest shareholder is Global Technology Acquisition I Sponsor Lp, with his 20% ownership. 683 Capital Management, LLC and Saba Capital Management, LP hold 6.1% and 5.5% of the outstanding shares respectively, making it his second and third largest shareholder.

Further research revealed that nine of the top shareholders accounted for about 52% of the registry. This means that in addition to the large shareholders there are a small number of minor shareholders, which somewhat balance each other’s interests.

It makes sense to study institutional investor data for companies, but it also makes sense to study analyst sentiment to get an idea of where the wind is heading. As far as we know, there’s been no analyst coverage of the company, so it’s probably keeping a low profile.

Insider Ownership of Global Technology Acquisition I

The definition of an insider may vary slightly from country to country, but board members are always important. Management finally answers to the board. However, it is not uncommon for managers to be members of the board of directors, especially for founders and CEOs.

I usually think insider ownership is a good thing. However, in some cases, it becomes more difficult for other shareholders to hold the board accountable for decision making.

Our data suggests that insiders own less than 1% of Global Technology Acquisition Corp. I in their own name. However, insiders may have an indirect interest through more complex structures. The board appears to own about US$1.2 million worth of stock. This compares to a market capitalization of US$251 million. Many small business investors want their boards to invest more. Click here to see if those insiders are buying or selling.

general public

The general public (consisting primarily of private investors) with 20% ownership has some influence over Global Technology Acquisition I. Run.

Private Company Ownership

You can see that the private company owns 20% of the outstanding shares. Private companies may be related parties. An insider may have an interest in a public company through his or her holdings in a private company rather than through his or her ability as an individual. It is difficult to draw broad conclusions, but it deserves attention as an area for further research.

Next step:

It’s always worth thinking about the different groups that own shares in the company. However, to better understand Global Technology Acquisition I, many other factors must be considered. Like risk, for example.All companies have them and we found 3 Warning Signs of Global Technology Acquisition I (two of which should not be ignored!) you need to know.

of course This may not be the best stock to buySo you may want to see us freedom A collection of interesting prospects boasting good finances.

Note: The numbers in this article are calculated using the last 12 months of data. This refers to his 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the annual report figures for the full year.

Do you have feedback on this article? What interests you? contact directly with us. Or send an email to our editorial team (at) Simplywallst.com.

This article by Simply Wall St is general in nature. We provide comments based on historical data and analyst projections using only unbiased methodologies and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. We aim to deliver long-term focused analysis based on fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Is not …

The views and opinions expressed herein are those of the authors and do not necessarily reflect those of Nasdaq, Inc.